Table of contents

How to reduce customer acquisition cost: Top 6 strategies in 2026

May 5, 2025

7 mins read

Written by Arslan Jadoon

Customer Acquisition Cost (CAC) represents the total investment needed to convert a prospect into a paying customer. Simply put, it’s how much money you spend to get someone to buy your product or service. Managing this number effectively can mean the difference between thriving and barely surviving for businesses of all sizes.

Think about it: if you’re spending $300 to acquire customers who only generate $200 in revenue, your business model isn’t sustainable.

Many businesses struggle with high acquisition costs because they spread their marketing budget too thin across multiple channels or target audiences that aren’t likely to convert. Others fail to track their spending accurately, making it impossible to identify which strategies work.

But what makes CAC reduction particularly challenging in today’s environment?

This comprehensive guide will walk you through understanding CAC, calculating it accurately, and implementing proven strategies to reduce it. We’ll explore how analytics tools like Usermaven can provide the insights needed to make data-driven decisions, and how finding the right balance between acquisition and retention can lead to sustainable growth.

Power up your SaaS

with perfect product analytics

*No credit card required

What is customer acquisition cost (CAC), and why does it matter?

Customer Acquisition Cost is the total amount of money spent on sales and marketing activities needed to acquire a new customer. This includes everything from advertising expenses and content creation to the salaries of your marketing and sales teams, as well as the tools and technologies they use.

For example, if your company spent $50,000 on marketing and sales in a month and acquired 100 new customers during that period, your CAC would be $500 per customer. To avoid missing hidden costs and ensure consistency across reporting periods, many businesses use an expense report template to log and categorize their marketing and sales spend before performing CAC calculations.

CAC matters because it directly affects your company’s profitability and the sustainability of your business model. When your CAC is too high compared to what customers spend with you over time (their lifetime value or LTV), your business is essentially losing money with each new customer you acquire.

“Understanding your CAC gives you clarity on how much you can afford to spend to acquire a customer while still maintaining profitability. It’s the reality check every business needs.”

CAC also helps you:

- Evaluate the effectiveness of different marketing channels and campaigns

- Make informed decisions about where to allocate your marketing budget

- Set appropriate pricing for your products or services

- Determine if your current business model is sustainable

How does CAC differ from other similar metrics?

While CAC looks at the cost to acquire a paying customer across all marketing and sales efforts, Cost Per Acquisition (CPA) typically focuses on the cost to achieve a specific conversion action (like a form submission or app download) within a single campaign. CAC gives you the big-picture view of your acquisition economics, while CPA helps optimize individual marketing initiatives.

How to calculate customer acquisition cost accurately?

Calculating customer acquisition cost accurately requires capturing all costs associated with acquiring new customers during a specific timeframe. The basic formula is straightforward:

CAC = Total sales and marketing costs ÷ Number of new customers acquired

Let’s break down what should be included in “Total sales and marketing costs”:

- Advertising spend (paid search, social media ads, display advertising)

- Content marketing expenses (blog posts, videos, podcasts)

- Website maintenance and SEO

- Marketing and sales team salaries, bonuses, and commissions

- Software subscriptions for marketing and sales (CRM, email marketing, etc.)

- Agency or consultant fees

- Event marketing costs

- Promotional materials and discounts are offered to new customers

For example, if your company spent $150,000 on these activities in a quarter and acquired 300 new customers, your CAC would be $500 per customer.

To calculate CAC for specific channels, you can use this modified formula:

Channel CAC = Channel-specific marketing costs ÷ Number of customers acquired through that channel

This helps you compare the efficiency of different acquisition channels. For instance, you might discover that your CAC from organic search is $250, while your CAC from paid social is $600. This insight would suggest reallocating the budget toward SEO efforts.

For subscription-based businesses, it’s also important to calculate the payback period:

Payback Period = CAC ÷ Average monthly revenue per customer

This tells you how many months it takes to recoup your acquisition costs. A shorter payback period means faster recovery of your investment and better cash flow.

Power up your SaaS

with perfect product analytics

*No credit card required

Effective strategies to reduce customer acquisition cost

Implementing targeted strategies to reduce CAC can significantly improve your business’s profitability. Here are proven approaches that can help lower your acquisition costs while maintaining or even increasing customer quality:

1. Identify and target your ideal customer segments

Understanding exactly who your most valuable customers are allows you to focus your marketing efforts where they’ll generate the highest return. Create detailed buyer personas based on your existing customer data, including demographics, behaviors, pain points, and purchasing patterns.

To effectively target your ideal segments:

Analyze your existing customer base to identify common characteristics among your most profitable customers. Use Usermaven to track user behavior and conversion patterns. Develop tailored messaging that addresses the specific pain points of each segment. Test different audience targeting parameters in your ad campaigns to find the most responsive groups.

2. Optimize your customer acquisition funnel

Every step a potential customer takes from initial awareness to purchase represents a potential drop-off point. Identifying and fixing these leaks can dramatically improve conversion rates without increasing spending.

Start by mapping your entire customer journey and measuring conversion rates between each stage. Look for significant drop-offs – these are your opportunity areas. For example, if 5% of visitors add products to their cart, but only 1% complete a purchase, your checkout process likely needs improvement.

Common conversion funnel optimization tactics include:

- Simplifying landing pages to focus on a single call-to-action.

- Testing different versions of key pages through A/B testing.

- Reducing form fields to the absolute minimum needed.

- Implementing abandoned cart recovery emails or retargeting campaigns.

- Adding social proof elements like reviews or testimonials at critical decision points.

3. Leverage content marketing and SEO

Content marketing and SEO typically have higher upfront costs but deliver customers at a significantly lower CAC over time compared to paid advertising.

Creating valuable content that addresses your target audience’s problems positions your brand as a trusted resource. When this content ranks well in search engines, it continues to drive qualified traffic without ongoing costs.

To maximize the impact of content marketing on CAC:

Focus on creating comprehensive resources that target high-intent keywords. Update existing content regularly to maintain relevance and search rankings. Develop content clusters around key topics to establish topical authority. Create conversion-focused assets like case studies, comparison guides, and templates that address bottom-of-funnel needs.

4. Implement and optimize referral programs

Satisfied customers can become your most cost-effective acquisition channel through well-designed referral programs. These programs leverage the trust between friends and colleagues to bring in pre-qualified prospects.

“People influence people. Nothing influences people more than a recommendation from a trusted friend. A trusted referral is the Holy Grail of advertising.”

When designing a referral program:

Make the referral process extremely simple. Offer incentives that benefit both the referrer and the new customer. Provide referrers with easy-to-share content and links. Track referral sources to identify your most effective advocates.

5. Leverage marketing automation and analytics

Marketing automation allows you to deliver personalized experiences at scale while reducing manual effort. Combined with robust analytics, automation helps ensure your marketing messages reach the right person at the right time.

Usermaven provides detailed insights into user behavior and conversion patterns, allowing you to:

Track the entire customer journey from first touch to purchase and beyond. Identify which channels and campaigns drive the most valuable customers. Understand which features or content correlate with higher conversion rates. Segment users based on behavior to deliver more targeted messaging.

6. Improve customer retention and generate referrals

Since acquiring new customers typically costs 5-25 times more than retaining existing ones, improving retention directly affects your overall acquisition costs. Higher retention rates mean you need fewer new customers to grow, and satisfied customers are more likely to refer others.

Focus on creating an exceptional onboarding experience that helps customers quickly realize value from your product. Implement a systematic approach to collecting and acting on customer feedback. Develop educational content that helps customers get more value from your product over time.

Turn visitors into paying

customers with funnel analysis

*No credit card required

The role of customer acquisition software in reducing CAC

Customer acquisition software provides the data-driven insights and automation capabilities needed to significantly reduce acquisition costs. These tools help marketing teams understand what’s working, eliminate ineffective spending, and optimize campaigns for better results.

How Usermaven helps reduce customer acquisition costs

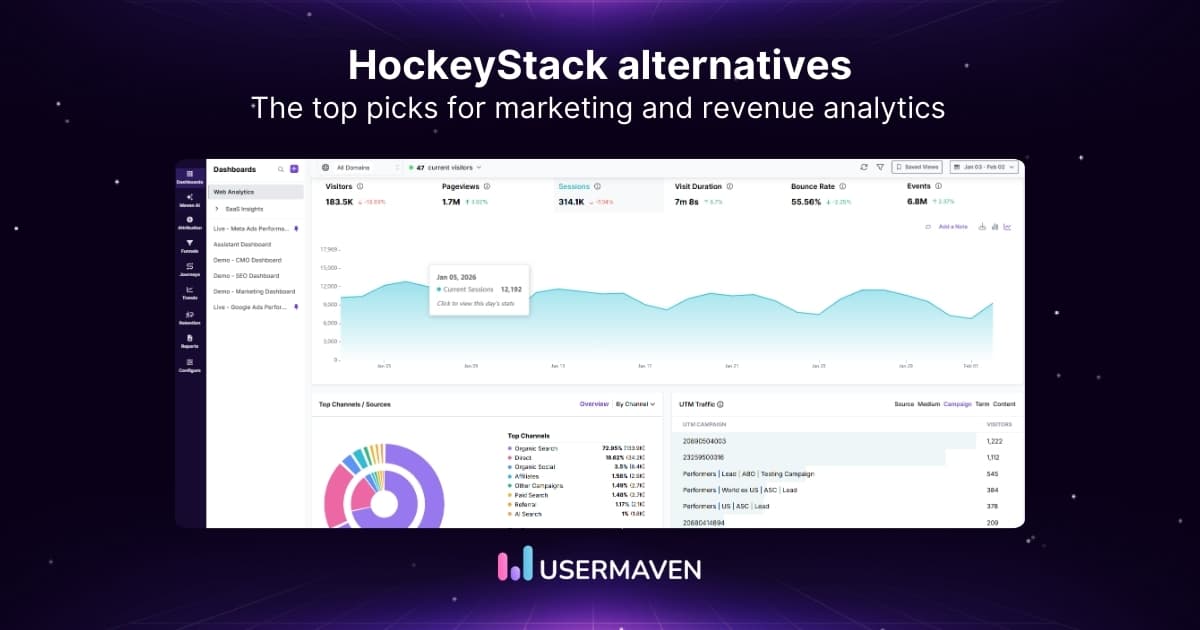

Usermaven stands out as a powerful yet simple analytics platform that gives marketing and product teams the insights they need to optimize their acquisition efforts. Unlike complex analytics tools that require extensive setup and technical expertise, Usermaven offers automatic event tracking without coding requirements, making it accessible to marketing teams of all sizes.

Key ways Usermaven helps reduce CAC include:

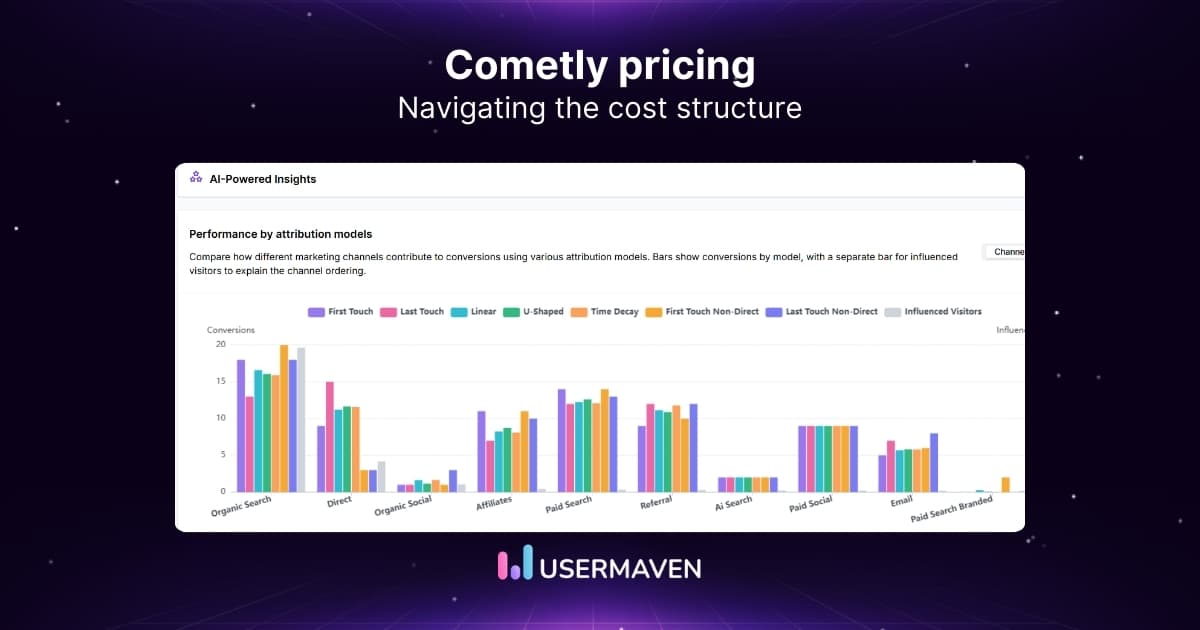

- Precise channel attribution: Usermaven tracks the entire customer journey across multiple touchpoints, showing you exactly which channels and campaigns are driving valuable customers. This multi-touch attribution capability helps you understand the true impact of each marketing channel, beyond just the last click.

- Conversion funnel analysis: Usermaven provides a detailed visualization of your entire acquisition funnel, highlighting exactly where potential customers are dropping off. This allows you to identify and fix conversion bottlenecks without guesswork.

- User behavior insights: Understanding how users interact with your website or product before converting helps you optimize the experience for higher conversion rates. Usermaven’s behavior tracking shows which features or content correlate with conversion, allowing you to emphasize these elements in your marketing and product development.

- Segmentation capabilities: Different user segments often have vastly different acquisition costs and conversion rates. Usermaven allows you to segment users based on behavior, demographics, or acquisition source, giving you insights into which segments provide the best return on investment.

- Real-time performance monitoring: Rather than waiting for monthly reports, Usermaven provides real-time data on campaign performance, allowing for quick adjustments to underperforming campaigns before wasting more budget.

Power up your SaaS

with perfect product analytics

*No credit card required

Other types of customer acquisition software

While Usermaven focuses on providing comprehensive analytics and insights, other types of software also play important roles in reducing CAC:

- CRM systems: Tools like HubSpot, Salesforce, and Pipedrive help manage customer relationships and track leads through the sales process, ensuring potential customers don’t fall through the cracks.

- Marketing automation platforms: Platforms such as HubSpot, Mailchimp, and ActiveCampaign automate repetitive marketing tasks like email sequences and social media posting, increasing efficiency and ensuring consistent follow-up.

- Landing page and website optimization tools: Solutions like Unbounce and Optimizely help create and test high-converting landing pages to maximize the return on your advertising spend.

- Social media management tools: Platforms like ContentStudio streamline social media marketing efforts, helping maintain an active presence without excessive time investment.

- Chatbots and conversation tools: Solutions like Intercom and Drift engage website visitors in real-time, answering questions and guiding them toward conversion when they’re most engaged.

The most effective approach combines these different types of software to create an integrated stack that addresses every aspect of customer acquisition. However, without proper analytics like what Usermaven provides, it’s difficult to know which tools and strategies are actually contributing to lower acquisition costs.

Customer acquisition vs. retention: Finding the right balance

While reducing CAC is crucial, focusing exclusively on acquisition without considering retention can lead to an unsustainable business model. The relationship between these two aspects of customer management significantly impacts your overall growth strategy and profitability.

The cost differential

Research consistently shows that acquiring a new customer costs 5-25 times more than retaining an existing one. This stark difference makes a strong case for investing in retention alongside acquisition efforts.

For subscription-based businesses, this cost differential is even more important. If customers churn before you’ve recouped your acquisition costs, growth becomes nearly impossible, regardless of how many new customers you bring in.

“Customer acquisition cost payback period is the number one metric that can sink a company. The longer it takes to recoup the initial investment, the more money is needed to fuel growth.”

What’s the right balance between acquisition and retention spending?

The answer varies depending on your business stage and model, but most mature businesses aim to spend 60-70% of their customer budget on acquisition and 30-40% on retention. However, if your churn rate is high, shifting more resources toward retention often yields better results than simply increasing acquisition spending.

How does retention impact acquisition?

Effective retention strategies directly impact your acquisition costs in several ways:

- Extended customer lifetime value: The longer customers stay, the more value they generate, improving your LTV: CAC ratio without requiring any reduction in acquisition costs.

- Word-of-mouth referrals: Satisfied long-term customers naturally refer others, creating a zero-cost acquisition channel.

- Reduced pressure on acquisition: Lower churn means you need fewer new customers to maintain or grow your business.

- Upselling and cross-selling opportunities: Existing customers are 50% more likely to try new products and spend 31% more compared to new customers.

- More data for optimization: Longer customer relationships provide more data to understand what drives value, helping you target similar prospects more effectively.

Practical ways to improve retention

To improve customer retention and thereby reduce the pressure on acquisition:

- Create a systematic onboarding process that helps new customers achieve their first success quickly.

- Implement regular check-ins and proactive support, especially during the early stages of the customer relationship.

- Develop a customer success program that helps customers achieve their goals with your product.

- Use segmented communication to deliver relevant content and offers based on customer behavior and preferences.

- Collect and act on customer feedback consistently, showing customers you value their input.

Power up your SaaS

with perfect product analytics

*No credit card required

Finding your optimal balance

The right balance between acquisition and retention depends on your specific business circumstances:

For startups with new products, focusing heavily on acquisition (70-80% of customer budget) makes sense to build an initial customer base.

For established businesses with stable products, a more balanced approach (50-60% acquisition, 40-50% retention) typically yields better results.

For businesses in competitive markets with high acquisition costs, investing more heavily in retention (40-50% acquisition, 50-60% retention) often provides the best return.

Monitor key metrics like Customer Lifetime Value (LTV), CAC, churn rate, and customer satisfaction scores to determine if your current balance is optimal. If your LTV: CAC ratio is below 3:1, or if your churn rate exceeds your new customer acquisition rate, consider shifting more resources toward retention.

Bottom line: How to reduce customer acquisition cost

Reducing customer acquisition cost requires a strategic approach that combines targeted marketing, funnel optimization, and leveraging the right technology. By accurately calculating your CAC, identifying the most effective channels, and implementing the strategies outlined in this guide, you can significantly lower your acquisition costs while maintaining or even improving customer quality.

Remember that the most sustainable approach combines CAC reduction with strong retention efforts. The combination creates a virtuous cycle: lower acquisition costs allow you to invest more in product and customer experience, which improves retention, which in turn reduces the pressure on acquisition.

Tools like Usermaven provide the insights needed to make data-driven decisions throughout this process. As a powerful marketing attribution software, it helps you clearly see which channels and campaigns drive conversions, revenue, and long-term customer value. This visibility makes it easier to identify where opportunities exist to optimize your funnel and reduce customer acquisition cost without sacrificing growth.

Power up your SaaS

with perfect product analytics

*No credit card required

FAQs about reducing customer acquisition cost

1. What’s the impact of targeting the wrong audience on customer acquisition cost?

Targeting the wrong audience significantly increases customer acquisition cost. When your marketing reaches unqualified leads, you waste budget without meaningful conversions.

2. How does attribution modeling impact customer acquisition cost?

Attribution modeling impacts customer acquisition cost by revealing which channels truly drive conversions, helping you optimize budget allocation and eliminate inefficient spending.

3. How can Usermaven help reduce customer acquisition cost?

Usermaven helps reduce customer acquisition cost by identifying high-performing acquisition channels and offering conversion insights, so you can scale what works and cut what doesn’t.

4. Why is it important to align sales and marketing to reduce CAC?

Aligning sales and marketing is important to reduce CAC because it ensures message consistency, improves lead quality, and shortens the sales cycle — all of which lower costs.

5. Can improving onboarding reduce future acquisition costs?

Improving onboarding can reduce future acquisition costs by boosting retention and satisfaction, which reduces churn and the need to acquire new customers constantly.

6. How do product-led growth strategies contribute to lower CAC?

Product-led growth strategies lower CAC by using the product itself to drive adoption and referrals, reducing reliance on paid acquisition channels.

Try for free

Grow your business faster with:

- AI-powered analytics & attribution

- No-code event tracking

- Privacy-friendly setup