Table of contents

4 Revenue forecasting models to boost your SaaS business

Aug 7, 2023

6 mins read

Written by Usermaven

SaaS businesses need not only to survive but thrive in highly competitive markets; therefore, revenue forecasting is paramount for maintaining a steady growth trajectory. Moreover, unlocking the growth potential of your SaaS business requires accurate revenue forecasting. But with ever-changing market dynamics, finding the right approach can be challenging.

This article unveils four powerful revenue forecasting models that SaaS companies can use to boost their sales. We will also explore why your SaaS business needs to perform revenue forecasts and how you can supercharge it with proven tips and tricks. Let’s dive in!

What is revenue forecasting?

Revenue forecasting is a process used to predict or estimate a company’s revenue generation over a specified period. It is a crucial practice in financial planning and strategic decision-making. It allows businesses to anticipate their expected earnings and plan their operations accordingly. Revenue forecasting typically involves analyzing historical data, market trends, customer behavior, and other relevant factors to make informed projections about future revenue streams.

Revenue forecasting can have the following objectives:

- Financial planning

- Short-term or long-term goal setting

- Performance evaluation

- Investor relations to assess the company’s potential and make investment decisions.

- Strategic decision-making, including product development, marketing strategies, expansion plans, and inventory management.

The revenue forecasting process may vary depending on the nature of the business and the available data. Some common methods used in revenue forecasting include qualitative techniques (e.g., expert opinions, market research, surveys) and quantitative techniques (e.g., time series analysis, regression analysis, and machine learning models). Combining these methods may be used to achieve more accurate and reliable forecasts.

Why is revenue forecasting important for SaaS businesses?

Revenue forecasting is crucial for SaaS businesses to manage their financial health, plan for growth, make strategic decisions, and maintain a competitive edge in a fast-paced and dynamic market. SaaS businesses have unique characteristics and challenges regarding revenue forecasting as they operate on a subscription-based model where customers pay regular fees to access their software over the Internet. Here are some reasons why revenue forecasting is crucial for SaaS businesses:

Revenue forecasting provides insights into when SaaS businesses can expect to recoup the high upfront costs for product development and customer acquisition and achieve profitability, ensuring their financial stability and long-term sustainability.

SaaS companies rely on a steady stream of recurring revenue from their subscribers. Accurate revenue forecasting helps them predict cash flow and ensure they have enough resources to cover operating expenses, invest in product development, and support ongoing customer needs. With revenue forecasting, businesses can anticipate subscription renewals and manage customer churn effectively to prevent revenue loss.

Accurate revenue forecasts are essential for valuing a SaaS company and attracting investors. Investors and potential acquirers use revenue projections to assess the business’s financial health and its potential for future growth. Revenue forecasts assist in setting appropriate pricing for SaaS products and services. By understanding the expected revenue per customer, SaaS businesses can optimize their marketing strategies and customer support services and allocate resources more effectively to acquire new customers.

What are the 4 types of revenue forecasting models?

There are several types of revenue forecasting models used across industries, and the choice of forecasting model depends on various factors, including the availability of data, the nature of the problem, the level of accuracy required, and the expertise of the forecasting team. Often, a combination of different models or hybrid approaches may be used to enhance the accuracy and reliability of the forecasts.

Let’s dig deeper into some common forecasting models for revenue.

Straight-line model

One of the basic revenue forecasting models is the straight-line model. It is based on the assumption that revenue growth is constant over time. It is also known as the Linear model or Linear regression. It offers an easy-to-use approach for gaining quick initial insights.

However, it is not suitable for analyzing complex and dynamic revenue trends. Thus, this forecasting model does not capture long-term forecasting, the impact of seasonality, and the influence of significant external influences. Therefore, businesses tend to use more sophisticated forecasting models that consider a wider range of factors and take into account the specific characteristics of their industry and market.

Pros:

- It is straightforward, easy to implement, and does not require advanced statistical knowledge. Thus, non-experts can also use it.

- It offers a quick estimation of future revenue trends, making it useful for initial insights and high-level projections.

- It is suitable when historical revenue data shows a stable and consistent growth pattern over time.

- Because of its simplicity, stakeholders, and decision-makers can easily comprehend it, making communication and understanding smooth across the organization.

Cons:

- This model assumes a constant growth rate, but in reality, revenue growth can be influenced by various factors, not following a linear trend. Thus, it may not accurately capture complex and fluctuating revenue patterns.

- It does not consider seasonality in revenue data, leading to inaccurate forecasts if the business experiences seasonal fluctuations.

- It does not incorporate external factors such as market changes, economic conditions, or competitive landscape, which significantly impact revenue growth.

- It is unsuitable for businesses that experience rapid growth or face dynamic market conditions and may yield unrealistic projections.

Bottom-up forecasting model

The bottom-up forecasting model aggregates individual sales forecasts from various business units or product lines to create an overall revenue forecast for the entire organization. Contrary to top-down forecasting, where a single forecast is imposed on the entire company, it offers a more granular and detailed estimation of revenue based on the specific inputs and insights from different operational levels within the organization.

In this model, a company’s different departments or product lines build their revenue forecast based on their understanding of market conditions, customer demand, and other relevant factors. These forecasts from various departments are then consolidated and aggregated at higher levels to form a comprehensive revenue forecast for the entire company. This process is iterative, where discussions between different departments oc

cur to align the forecasts and eliminate discrepancies.

Pros:

- This model offers a more detailed and realistic estimation of revenue forecasting as it incorporates specific insights and data from different operational levels.

- It encourages collaboration and empowers different teams to take ownership of their forecasts, leading to a more committed and accurate forecasting effort.

- It is a flexible model that adapts to changes within individual departments or markets. As conditions change, each unit can update its forecast accordingly, leading to a more responsive and agile overall revenue forecast.

- It also helps identify growth opportunities and potential risks and helps in making informed strategic decisions and resource allocations.

Cons:

- The bottom-up model can be time-consuming for large organizations with multiple departments or product lines. Coordination and consolidation of individual forecasts may require considerable effort and result in delays.

- Managing and combining forecasts from various departments can become complex, especially if different forecasting methodologies or data quality are used. Ensuring consistency and comparability between departmental forecasts requires careful attention.

- It may fail to capture higher-level market trends or strategic insights that a top-down forecasting approach may consider. Thus, companies need a balance between granularity and capturing the bigger picture.

The Pipeline revenue forecasting model

The pipeline revenue forecasting model is used in sales-driven businesses, especially those with longer sales cycles. It estimates future revenue based on the current opportunities or deals in the sales pipeline. This model considers the various sales process stages and assigns probabilities to each deal, reflecting the likelihood of closing successfully.

First, the sales pipelines are analyzed, including all the potential deals or opportunities that sales representatives actively pursue. Each deal is then categorized into different sales process stages, such as prospecting, qualification, sales proposal, negotiation, and closing. Next, the probabilities, representing the likelihood of successful sales closing, are assigned. These probabilities are based on historical data, the sales team’s experience, or other relevant factors.

Finally, the forecasted revenue is calculated by multiplying the potential revenue of each deal by its respective probability of closing successfully. The sum of all these probabilities-adjusted revenues provides the overall revenue forecast.

Pros:

- It offers a more realistic and action-driven forecast by concentrating on actual deals in progress.

- It provides visibility into the sales team’s performance and the overall health of the sales pipeline, enabling sales managers to identify potential bottlenecks and areas for improvement.

- This model is flexible and can be adjusted to reflect the changing possibilities as deals progress through different stages or the addition of new opportunities. It is responsive to real-time sales dynamics.

- It encourages the sales team’s accountability, as individual performance directly impacts the forecast.

Cons:

- Probability assignments are often subjective and can vary based on the judgment of individual sales representatives. This subjectivity may introduce biases and affect the accuracy of the forecast.

- The accuracy of the forecast heavily depends on the quality and reliability of the data captured in the sales pipeline. Inaccurate or outdated data can lead to misleading revenue projections.

- This model does not fully consider external factors impacting the overall revenue, such as market changes or economic trends.

- Also, businesses with long and complex sales cycles may find implementing this model challenging because accurately predicting the timing and success of deals that take considerable time to close can be demanding.

The Backlog revenue forecasting model

Businesses with ongoing projects or contracts use the Backlog revenue forecasting model. It estimates future revenue based on the backlog of orders or commitments already received by the company. This model considers the revenue that will be recognized as projects or contracts are completed and delivered to customers.

It begins by examining the backlog of orders or contracts that have been confirmed but not yet fulfilled or recognized as revenue. The model considers the revenue recognition schedule for each project or contract in the backlog. Revenue may be recognized based on milestones, project completion, delivery of goods or services, or other contractual terms. Using revenue recognition software can streamline this process, ensuring compliance and improving the accuracy of forecasting based on backlog data.The expected timelines for completing each project or fulfilling each contract help predict when revenue will be recognized. Finally, the forecasted revenue is calculated by summing up the revenue that is expected to be recognized from the backlog in each relevant period.

Pros:

- Since this model is based on order confirmation, it provides contractual certainty, assuming the projects are completed as planned.

- Businesses with stable and predictable backlogs can find more accuracy, especially with a history of consistent project timelines and delivery.

- It provides a forward-looking view, allowing businesses to anticipate revenue based on existing commitments, which can be particularly useful for resource planning and financial management.

- It is also well-suited for businesses with longer project timelines or contracts, as it can project revenue beyond the immediate future.

Cons:

- The model heavily relies on the existing backlog, which may not account for new business opportunities or changes in market conditions. It may not accurately capture changes in demand or sales dynamics.

- Also, potential cancellations or delays in projects or contracts may not be fully considered, leading to inaccuracies in the revenue forecast.

- The model may overestimate future revenue in case the backlog includes projects that are uncertain or have a history of delays.

- Also, it may not incorporate external factors that could impact future revenue, such as changes in market trends or economic conditions.

Some tips and tricks to do revenue forecasting for SaaS business

Revenue forecasting can be challenging for SaaS businesses due to their subscription-based revenue model. However, the below-mentioned tips can empower SaaS businesses to make more informed strategic decisions to drive growth and success.

- To build a foundation for your forecasts, analyze historical revenue data to identify patterns, trends, and seasonality.

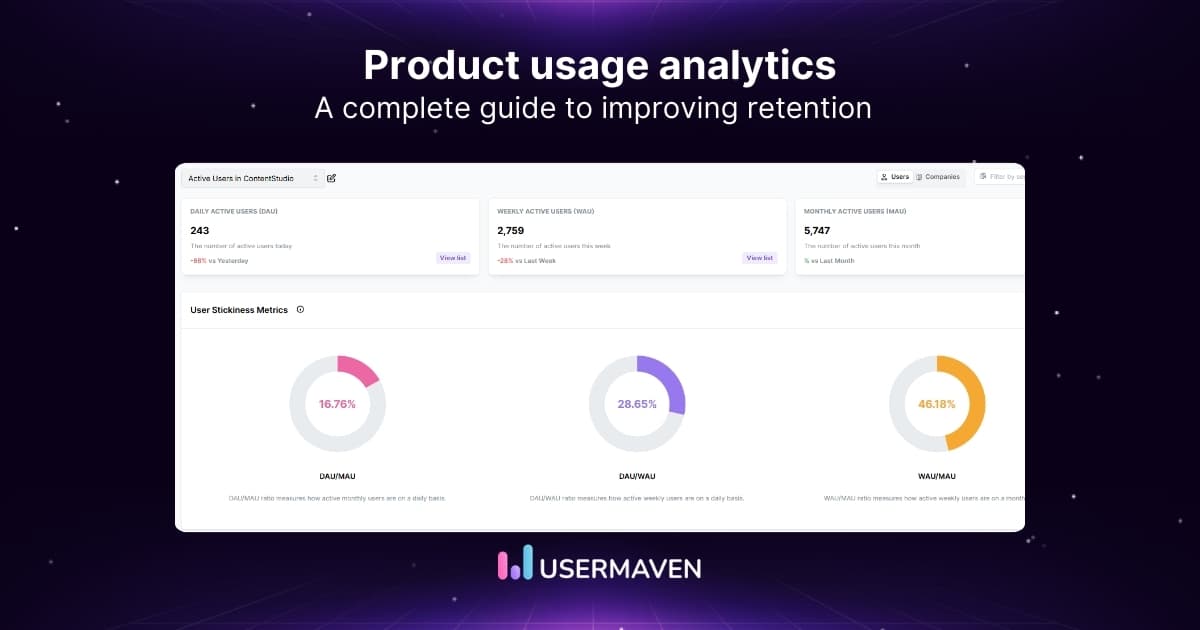

- Using data analytics tools like Usermaven, divide your customers into segments based on plan type, subscription tier, industry, or geography. Usermaven’s segmentation feature can provide insights into the revenue contribution from different customer groups and help you make more targeted forecasts.

- Calculate and analyze your churn rate to assess its impact on future revenue. Focus on reducing churn through customer retention strategies.

- Measure Customer Lifetime Value (CLV) as it helps you make more accurate revenue forecasts and informs decisions about customer acquisition costs.

- Account for potential expansion opportunities, such as upselling and cross-selling, from existing customers when forecasting revenue growth.

- With tools like Usermaven, keep a close eye on key performance indicators (KPIs) such as Monthly Recurring Revenue (MRR), Average Revenue Per User (ARPU), Customer Acquisition Cost (CAC), and Customer Lifetime Value (CLV). These metrics will give you valuable insights into the health and growth of your SaaS business.

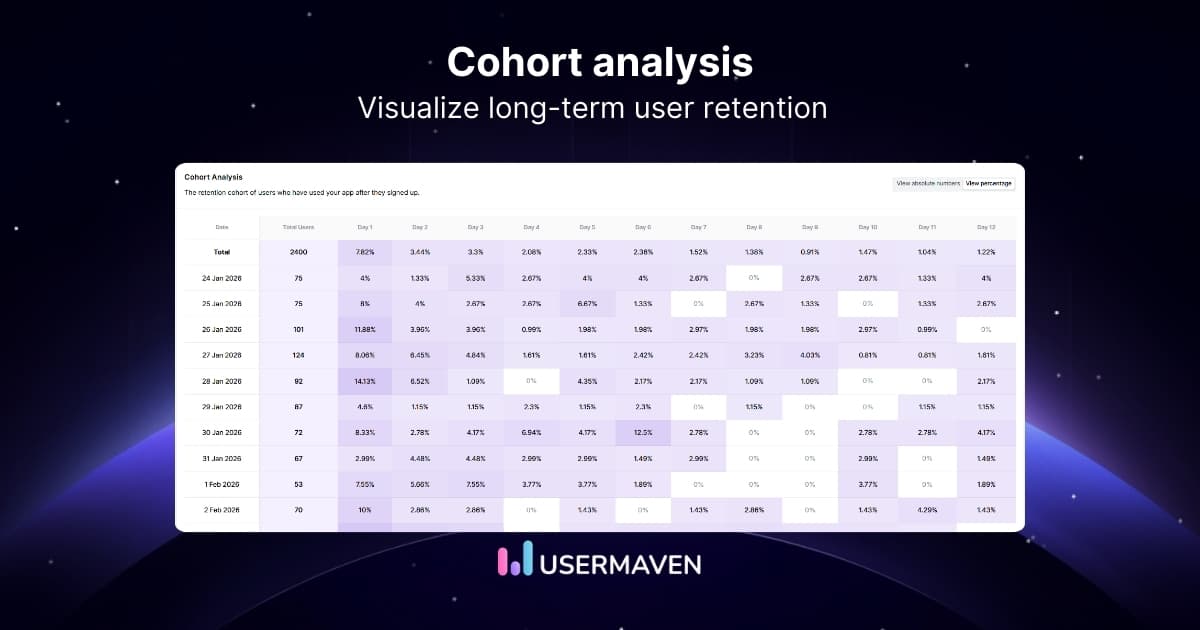

- Leverage cohort analysis to track the revenue performance of different groups of customers over time. It allows you to identify trends and behavior patterns among various customer cohorts, which can guide your revenue projections.

- Consider the influence of external factors on revenue, such as market trends, competitive landscape, economic conditions, and regulatory changes.

- Add data analytics and forecasting software into your business tech stack, as these tools often provide data integration, advanced analytics, and automation capabilities to streamline the forecasting process.

- Revenue forecasting is an iterative process. Continuously review and update your forecasts as new data becomes available and market conditions change.

FAQs

1. What is revenue forecasting?

Revenue forecasting is the process of predicting a business’s future revenue over a specific period. Historical data, market trends, customer behavior, and other relevant factors are analyzed in revenue forecasting to make informed future revenue projections.

2. What are the 4 types of forecasting models?

The four types of revenue forecasting models are; time series models, causal models, qualitative models, and judgmental models.

3. How can we create a revenue forecasting model?

A revenue forecasting model can be created in seven steps, including deciding a timeline, considering what may drive or hinder growth, estimating expenses, predicting sales, combining expenses and sales into a forecast, checking forecasts using key financial ratios, and testing scenarios by adjusting variables.

Try for free

Grow your business faster with:

- AI-powered analytics & attribution

- No-code event tracking

- Privacy-friendly setup